Your tax-deductible donation has the power to transform lives.

When you donate to charity, you’re providing someone with life-changing support, transforming families and communities. As the financial year-end approaches, you might want to make a tax-deductible donation as a way to give back to those less fortunate.

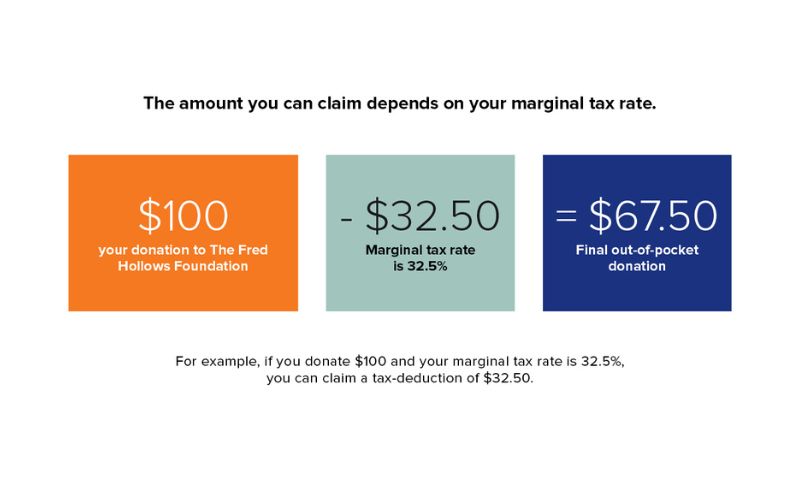

When you donate to The Fred Hollows Foundation, this gift can be claimed as a deduction on your Australian tax return. This means you can get more money back on your tax return while also giving back and making quality eye health care easily available to everyone. It really is a win-win situation!

9 out of 10 people who are blind or vision impaired don’t need to be, and we need people like you, now more than ever, to help us create a world where no one is needlessly blind.

When we restore a person’s sight, we give them a chance at independence. Your donation can help make sure that no one is left behind. We do this through investing in future generations of eye doctors, building local eye health capacity, driving innovation and advocating for the integration of eye health in national health systems.

Over the years, The Foundation has played a pivotal role in addressing blindness and vision loss. This is one of the reasons why Australians put their trust in us and donate to support our work.

How can I make a tax-deductible donation?

There are a few simple steps to claiming a tax deduction for charitable donations:

- Choose a registered charity. You can check the ACNC Charity Register to see if an organisation is registered as a charity or a Deductible Gift Recipient. The Fred Hollows Foundation is registered as a charity.

- Donate by June 30 to be eligible for a tax deduction in this financial year.

- Keep a record of your donation. When you give to The Foundation you will receive your receipt by email or mail, depending on how you donated. If you give monthly, you will receive your receipt for the previous financial year in July.

- Claim the deduction on your tax return. You can claim the deduction on your annual tax return by filling out the section titled "gifts and donations."

Where your tax-deductible donation goes

When you donate to The Fred Hollows Foundation, your contribution goes towards our sight-saving initiatives. This includes funding essential eye surgeries, treatments, training programs for surgeons and eye health workers, and other sustainable eye health interventions.

We believe in transparency and want you to know how your donation is allocated. For every $1 you donate, approximately 75 cents (75%) directly support our eye health programs. Around 6 cents (6%) are allocated to administrative costs necessary for running our operations efficiently. The remaining 18 cents (19%) are dedicated to fundraising efforts, which enable us to reach more people and increase our impact.

Maximise your impact

By becoming a part of our monthly giving program, you can help us to put an end to avoidable blindness in the most impactful way possible.

Our regular donors help us plan for long-term projects, meaning we can invest in innovation and technology that will make eye care services more affordable and available to people.

You can make a difference with as little as $25 per month, which can go a long way in supporting long-term eye care and transforming the future of entire communities.

Disclaimer: The above information is a guide only and The Fred Hollows Foundation does not provide legal or tax advice. You should always consider your personal circumstances and seek independent financial advice.