5 facts about Charitable Tax Deduction

#1 Which tax category are charitable donations deducted from?

Donations to tax-exempt charities or to the Government for charitable purposes can be deducted from your net assessable income under salaries tax, assessable profits under profits tax and total income under personal assessment.

You can be The Fred Hollows Foundation's donor!

To thank you for your generous support, we have specially designed a set of two limited edition “Eye Health Heroes” lens cloths for you. Starting from today, if you sign up as a monthly donor, you can receive one “Eye Health Hero” lens cloth. The lens cloth design will be selected randomly. For a monthly donation of HK$350 or more, you will receive a set of two lens cloths. Be a Visionary and donate now to empower more eye health heroes.

5 facts about Charitable Tax Deduction

#2 How do I find out if I am donating to an "Approved charitable donation"?

An "approved charitable donation" means a donation of money to any charitable institution or trust of a public character, which is exempt from tax under section 88 of the Inland Revenue Ordinance, or to the Government, for charitable purposes. (Section 2 of the Inland Revenue Ordinance).

You can click the list of charitable institutions and trusts

which are exempt from tax under section 88 of the Inland Revenue Ordinance to check eligibility of the recipient of your donation.

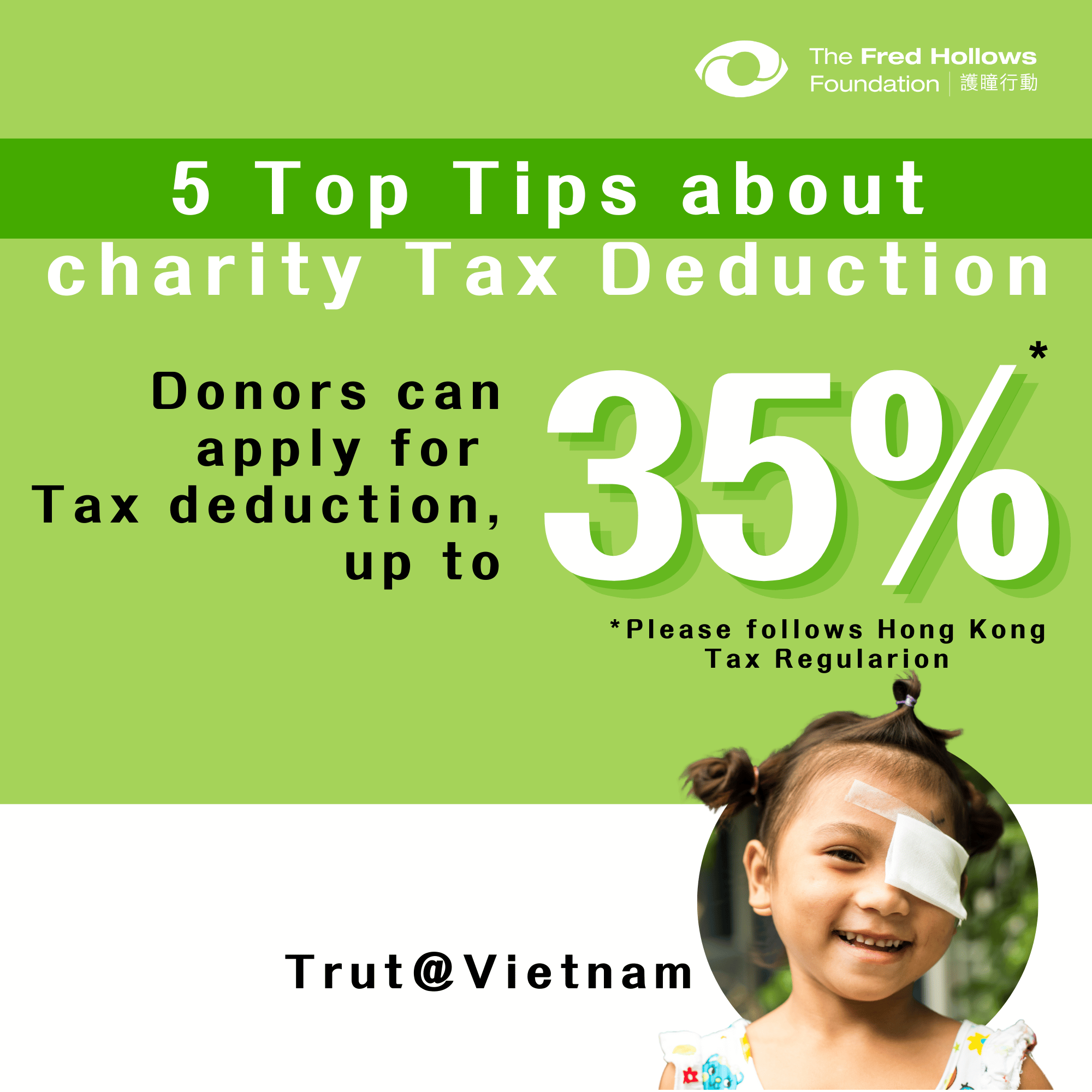

#3 How am I eligible to apply for a charitable tax deduction?

According to Hong Kong tax regulations, with the receipt of accumulated charitable donations amounting to HK$100 or above annually, donors can apply for tax deduction (up to 35% of the assessable income or profits). To lodge a claim for deduction, you should enter the total amount of approved charitable donations made during the relevant year of assessment in your Tax Return – Individuals (BIR60).

5 facts about Charitable Tax Deduction

#4 What supporting documents do I need to apply for a tax return?

Regular donors will receive an annual donation receipt from The Fred Hollows Foundation Hong Kong by the end of April each year. The annual receipt will list the total donations made in the past financial year for tax deduction purposes.

You do not need to attach any supporting documents at the time of submission of your Tax Return – Individuals, but you are advised to obtain receipts and retain them for a period of 6 years after the expiration of the year of assessment in which the donations were made. If your case is selected for review then you are required to produce receipts for examination.

#5 What kind of donations are not eligible for tax deduction?

According to the Inland Revenue Department, the following kinds of donations are not eligible for tax deduction: Payments for lottery or raffle tickets. Payments for admission to film shows or charity shows. Payments for grave spaces. Payments made for services such as saying prayers or the reservation of a space for ancestral worship. Purchase of goods in bazaars. Payments made to a church, a tax-exempt charity, by placing cash in the donation bag during Sunday masses except where donation receipts could be produced to prove the amount of donation made by the claimant.

Reference: GovHK website

Are donations made to The Fred Hollows Foundation tax deductible?

Special: Can your spouse also receive tax deductions from your charitable donations?

For married individuals, if donations exceed 35% of their income, the surplus can be claimed by the spouse. To claim deductions for charitable donations, both you and your spouse can fill in the total donation amount paid within the relevant tax year on the individual tax return form (BIR60).

To understand how charitable tax deductions are calculated, please click on the salary tax calculator (*2024-2025).

外地派遣醫護人員 VS 「自給自足」

「培養好一位眼科手術醫生,他將來就會培養數以百計的眼科人才。」 - 霍洛教授

護瞳行動認為從外地派遣醫護人員到偏遠地區,並非最佳的醫療發展模式。我們的工作模式﹐是在地訓練新一代的眼科醫療人員,期望服務地區能長遠在眼科醫療「自給自足」。投資培訓,能達致以下的效果和影響︰

WHAT IMPACT CAN YOUR DONATION BRING?

Blindness and vision impairment is a health issue, and related to a person's well-being, quality of life and development opportunities. The Fred Hollows Foundation believes that a fly-in-fly-out model is not the best way to develop a place’s eye health care. Our vision is to build sustainable, good quality and affordable eye care in remote areas of the world.

Your donation will be used to:

- Train surgeons or eye health workers

- Provide medical equipment

- Organise eye screening camps in remote areas

- Raise awareness of eye health to the public

- Invest in innovation and research

Together, we can do this

We know how to help, but there’s a lot of work still to be done across the world. Eliminating avoidable blindness can be achieved – with the help of our partners and, most importantly, you, our incredible supporters.

The Fred Hollows Foundation's work will help build the local capacity of eye health in remote areas. Doctors, nurses and community eye care staff can identify, diagnose, refer and treat various eye diseases on time in the community.

The Fred Hollows Foundation believes that a fly-in-fly-out model is not the best way to develop a place’s eye health care. Our aim is to build a sustainable eye health workforce in remote areas to help people have their sight restored.

Thank you very much for your donation! Monthly donation receipts will be mailed to your mailing address every April. If you have any questions, please feel free to contact us.